Best Credit Cards to Earn GameStop Gift Cards

Are you an avid gamer who regularly shops at GameStop? What if you could turn your everyday purchases into free games and gaming accessories? Using credit cards to earn GameStop gift cards is a strategic way to fund your gaming habit without spending extra money. The right rewards credit card can transform routine expenses like groceries, gas, and bills into GameStop currency for your next gaming purchase.

In today’s credit card marketplace, numerous options allow you to earn rewards that can be converted to GameStop gift cards through various redemption methods. Whether you prefer straightforward cash back, points programs with flexible redemption options, or rotating category bonuses, there’s likely a card that matches your spending patterns and gaming goals.

This comprehensive guide explores the best credit cards for GameStop rewards and how to maximize your earning potential. We’ll examine different reward structures, compare top card offerings, and provide practical redemption strategies so you can earn GameStop gift cards with credit cards efficiently and responsibly.

Types of Credit Card Rewards

Before diving into specific card recommendations, it’s important to understand the main types of credit card reward programs and how they can be leveraged for GameStop purchases:

Cashback Rewards

Cashback rewards are the most straightforward path to GameStop gift cards:

- How they work: You earn a percentage of your purchases back as cash rewards

- Redemption flexibility: Cash can typically be redeemed as statement credits, direct deposits, or gift cards (including GameStop)

- Simplicity factor: Easy to understand with no point valuation calculations

- Typical earning rates: Range from 1-2% base rewards with 3-5% in bonus categories

Many cashback cards offer bonus categories that align well with everyday spending, allowing you to maximize earnings on purchases you’d make anyway. Some programs even offer boosted redemption rates when choosing gift cards over cash.

Points Programs

Points-based rewards offer potential for higher value but require more strategy:

- How they work: Purchases earn points that can be redeemed through the card issuer’s rewards portal

- Flexibility: Points can often be redeemed for travel, merchandise, gift cards, or cash

- Potential for higher value: Some programs offer bonus redemption options or transfer partners

- Complexity: Requires understanding point values across different redemption options

The key advantage of points programs is their versatility. If your gaming needs change, you can redirect your points to other redemption options without switching cards.

Miles Programs

Travel rewards cards that earn miles can still help with your GameStop shopping:

- Primary purpose: Designed for travel redemptions

- Gaming relevance: Many travel cards offer “purchase erasers” or gift card options

- Indirect benefits: Some allow point transfers to other reward programs

- Consideration: Usually best for frequent travelers who also want gaming benefits

While miles programs aren’t typically the most efficient for earning GameStop gift cards, they can provide this option while primarily serving travel needs.

Which Type Is Best for GameStop Gift Cards?

For most gamers, cashback cards offer the most direct and efficient path to GameStop gift cards. They provide:

- Predictable redemption values

- Lower annual fees (often $0)

- Straightforward redemption processes

- No complex transfer strategies needed

However, if you’re looking to maximize value across multiple spending categories or want flexibility between gaming purchases and other rewards, a transferable points program might be worth the additional complexity.

Top Credit Cards for Earning GameStop Gift Cards

Let’s examine the best cards currently available for earning rewards that can be converted to GameStop gift cards:

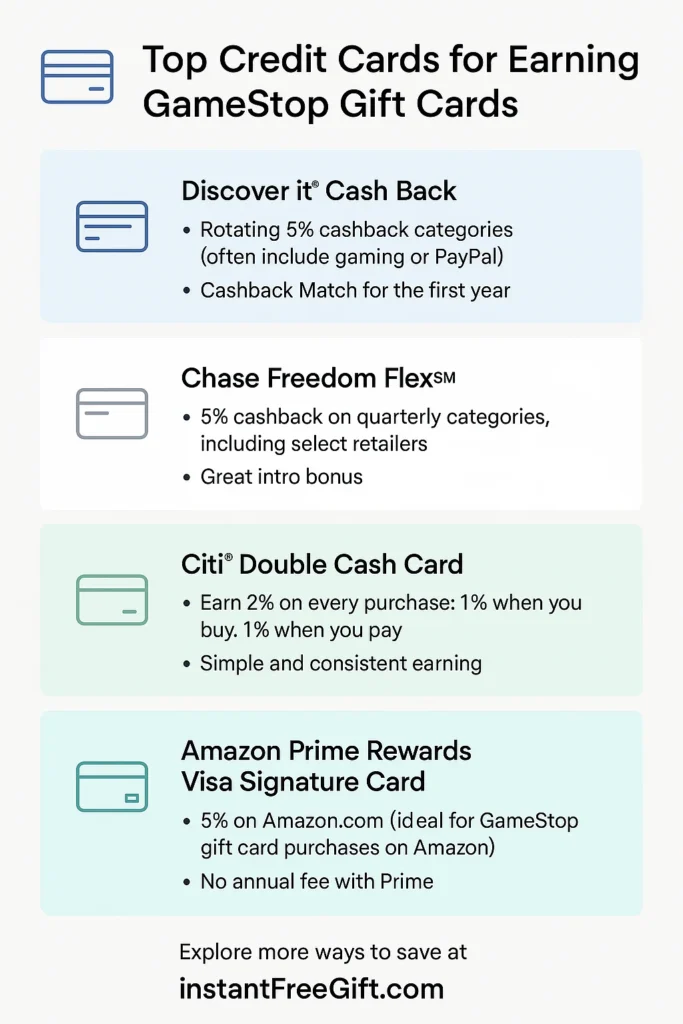

1. Discover it® Cash Back

The Discover it® Cash Back card stands out as a premier option for earning GameStop gift cards:

- Base rewards: 1% unlimited cash back on all purchases

- Bonus categories: 5% cash back on rotating quarterly categories (up to quarterly maximum when activated)

- Key gaming benefit: Discover’s reward portal offers GameStop gift cards, sometimes with discounted redemption rates

- Unique advantage: Cashback Match™ doubles all rewards earned in your first year

- Annual fee: $0

- Redemption minimum: As low as $20 for gift cards

- Rotating categories often include: Amazon, Walmart, PayPal, and other retailers where you might purchase gaming items

The first-year Cashback Match feature essentially turns this into a 2% base/10% category card during your first year, making it particularly valuable for new cardholders looking to maximize their GameStop rewards.

Best for: Gamers willing to track rotating categories who want to maximize rewards in their first year of card membership.

2. Chase Freedom Flex℠

The Chase Freedom Flex℠ combines category bonuses with versatile redemption options:

- Base rewards: 1% cash back on general purchases

- Bonus categories:

- 5% on rotating quarterly categories (up to $1,500 in combined purchases when activated)

- 3% on dining and drugstore purchases

- Key gaming benefit: Chase Ultimate Rewards portal offers GameStop gift cards

- Annual fee: $0

- Additional perks: Purchase protection, extended warranty

- Strategic advantage: Can be paired with premium Chase cards for increased redemption value

Chase’s Ultimate Rewards program provides excellent flexibility, allowing you to choose between GameStop gift cards or other redemption options as your needs change.

Best for: Gamers who also spend significantly on dining and want purchase protection for their gaming equipment.

3. Citi® Double Cash Card

For simplicity and consistent rewards, the Citi® Double Cash Card offers:

- Base rewards: Effectively 2% on all purchases (1% when you buy + 1% when you pay)

- Key gaming benefit: Straightforward redemption for GameStop gift cards through ThankYou Points portal

- Annual fee: $0

- Redemption options: Gift cards, statement credits, direct deposit

- Advantage: No categories to track—ideal for streamlined rewards

With no bonus categories to track, this card provides consistent earnings on every purchase, making it perfect for gamers who prefer simplicity over maximizing specific categories.

Best for: Gamers seeking a hassle-free, no-annual-fee option with above-average base rewards rate.

4. Amazon Prime Rewards Visa Signature Card

For those who purchase games through Amazon as well as GameStop:

- Base rewards: 1% back on general purchases

- Bonus categories:

- 5% back at Amazon.com and Whole Foods Market (with eligible Prime membership)

- 2% back at restaurants, gas stations, and drugstores

- Key gaming benefit: Amazon sells GameStop gift cards, effectively allowing 5% earnings

- Annual fee: $0 (requires Amazon Prime membership)

- Redemption options: Amazon.com credit, statement credits, gift cards

This card provides an indirect but effective path to GameStop gift cards by purchasing them from Amazon at a 5% reward rate.

Best for: Gamers who are already Amazon Prime members and split their gaming purchases between Amazon and GameStop.

5. Capital One Venture Rewards Credit Card

For gamers who also travel, the Capital One Venture card offers versatility:

- Base rewards: 2 miles per dollar on all purchases

- Key gaming benefit: “Purchase eraser” can be used to offset GameStop purchases charged to the card

- Annual fee: $95

- Redemption rate: Each mile is worth 1 cent toward statement credits for purchases

- Flexibility: Use for GameStop or travel as needed

- Additional travel perks: No foreign transaction fees, TSA PreCheck/Global Entry credit

While primarily a travel card, the purchase eraser feature makes this a viable option for earning GameStop gift cards while maintaining travel benefits.

Best for: Gamers who travel frequently and want the flexibility to use rewards for either gaming or travel expenses.

For more ways to maximize your gaming budget, check out our guide to GameStop PowerUp Rewards: Everything You Need to Know to combine credit card rewards with store loyalty benefits.

How to Redeem Credit Card Rewards for GameStop Gift Cards

Once you’ve accumulated rewards, here’s how to convert them to GameStop gift cards with each of the recommended cards:

Discover it® Cash Back Redemption

- Log in to your Discover account online or via the mobile app

- Navigate to the Rewards section

- Select “Redeem” and choose “Gift Cards & eCertificates”

- Find GameStop in the retailer list (use the search function or browse categories)

- Choose your gift card denomination (typically $25, $50, or $100)

- Complete the redemption process and receive the gift card code via email

- Bonus tip: Watch for redemption promotions where gift cards may be offered at a discount (e.g., a $25 card for $20 in cashback)

Chase Freedom Flex℠ Redemption

- Access your Chase account and go to “Ultimate Rewards”

- Select your Freedom Flex card if you have multiple Chase cards

- Choose “Redeem for Gift Cards” from the redemption options

- Search for GameStop in the merchant list

- Select your preferred denomination and complete the redemption

- Delivery options: Digital gift cards typically arrive by email within 1-2 business days

- Advanced strategy: If you also have a Chase Sapphire Preferred or Reserve card, consider transferring points to that card first for potentially higher value redemptions

Citi® Double Cash Card Redemption

- Log in to your Citi account and navigate to the ThankYou Rewards center

- Convert cash rewards to ThankYou Points if not done automatically

- Select “Shop with Points” and then “Gift Cards”

- Find GameStop in the merchant directory

- Choose your gift card amount based on available point balance

- Complete the redemption and receive your digital code

- Note: Citi occasionally offers point discounts on certain gift card categories

Amazon Prime Rewards Visa Signature Card (Indirect Method)

- Use your Amazon Prime Rewards card to purchase a GameStop gift card directly from Amazon

- Automatically earn 5% back on this purchase with an eligible Prime membership

- Apply rewards as a statement credit to offset the purchase

- Alternative: Use points directly on Amazon to buy the GameStop gift card

- Digital delivery: Gift card codes are typically delivered instantly via email

- Physical cards: Optional if you prefer a physical gift card to be shipped

Capital One Venture Rewards Credit Card (Purchase Eraser Method)

- Make a purchase at GameStop using your Venture card

- Wait for the transaction to post to your account (typically 1-3 days)

- Log in to your Capital One account and find the “Rewards” section

- Select “Cover Your Purchases” (the Purchase Eraser feature)

- Choose the GameStop transaction from your recent purchases

- Apply miles to erase the purchase partially or fully

- Timing note: You generally have 90 days from purchase date to use the eraser feature

Understanding these redemption processes helps ensure you get maximum value from your rewards when converting them to GameStop gift cards.

Factors to Consider When Choosing a Rewards Credit Card

Not all rewards cards are created equal, and the best credit card for GameStop rewards depends on your personal financial situation and spending habits:

Spending Habits

- Category alignment: Choose a card with bonus categories that match where you spend most

- Spending volume: Higher spenders may benefit from cards with higher rewards caps

- Spending consistency: Consider whether your spending is spread evenly or concentrated in specific categories

- Question to ask: “Where do I spend most of my money each month?”

For example, if you spend heavily on groceries and gas, a card with bonus rewards in these categories will generate more rewards for GameStop gift cards than a flat-rate card.

Annual Fees

- Fee justification: Calculate whether your rewards will exceed any annual fee

- Break-even analysis: Determine the spending required to offset the fee

- No-fee alternatives: Compare rewards rates with no-annual-fee options

- Additional benefits: Consider whether premium benefits justify the fee

- Question to ask: “Will I earn enough additional rewards to justify paying an annual fee?”

For most gamers seeking GameStop gift cards, no-annual-fee cards often provide the best value unless you’re a very high spender or can utilize premium travel benefits.

Interest Rates

- Payment habits: Only consider rewards if you pay your balance in full each month

- APR comparison: If you occasionally carry a balance, prioritize lower APRs over rewards

- Promotional offers: Consider 0% intro APR offers for large gaming purchases

- Warning: Interest charges typically far outweigh reward earnings

- Question to ask: “Do I consistently pay my balance in full each month?”

Remember that carrying a balance on rewards cards negates any benefit from earning GameStop gift cards due to interest charges.

Credit Score Requirements

- Approval likelihood: Most premium rewards cards require good to excellent credit (670+)

- Credit building options: Consider secured or student rewards cards if your credit is limited

- Application strategy: Avoid multiple applications in a short timeframe

- Question to ask: “Does my credit profile match the card’s typical approval requirements?”

If you’re uncertain about your approval odds, many issuers offer pre-qualification tools that won’t impact your credit score.

Reward Caps and Limitations

- Spending caps: Be aware of limits on bonus category earnings

- Redemption minimums: Check if there’s a minimum reward balance needed for redemption

- Expiration policies: Understand if/when your rewards expire

- Redemption options: Verify that GameStop gift cards are specifically available

- Question to ask: “Are there restrictions that would limit my ability to earn or use rewards?”

For more information on maximizing value while shopping at GameStop, read our article on How to Use GameStop Receipt Scanning Apps to Get Free Credit.

Alternatives to Using Credit Cards

While credit cards for GameStop gift cards offer excellent value, they’re not the only option:

Gift Card Exchange Websites

- How they work: Buy discounted GameStop gift cards from people selling unwanted cards

- Potential savings: Typically 2-13% below face value

- Popular platforms: Raise, CardCash, GiftCardGranny

- Caution: Verify site legitimacy and buyer protections before purchasing

Rewards Apps and Browser Extensions

- Shopping portals: Earn cash back through apps like Rakuten, TopCashback, or Ibotta

- Browser extensions: Honey, Capital One Shopping, and similar tools find discount codes

- Survey apps: Swagbucks, Survey Junkie, and similar platforms convert time to rewards

- Combination strategy: Stack these with credit card rewards for maximum benefit

GameStop’s PowerUp Rewards Program

- Store loyalty: Earn points directly through GameStop’s own program

- Pro membership: Pays for itself with monthly $5 rewards certificates

- Trade-in bonuses: Get extra credit when trading in games and equipment

- Synergy potential: Combine with credit card rewards for dual earnings

Receipt Scanning Programs

- Retail apps: Apps like Fetch Rewards and Receipt Hog reward you for uploading receipts

- GameStop-specific: Some receipt programs offer specific bonuses for GameStop purchases

- Passive earning: Minimal effort for incremental rewards

Responsible Credit Card Use

Maximizing rewards for GameStop gift cards should never come at the expense of financial health:

Pay Your Balance in Full Each Month

- Interest negates rewards: Even one month of interest typically exceeds a year of rewards

- Payment strategy: Set up automatic payments for at least the minimum due

- Budget alignment: Only charge what you can afford to pay off each statement

- Emergency fund: Maintain savings to avoid carrying balances when unexpected expenses arise

Avoid Overspending

- Reward psychology: Don’t let rewards justify purchases you wouldn’t otherwise make

- Budget first: Set gaming spending limits before considering rewards

- Track spending: Use card issuer tools or budgeting apps to monitor your charges

- Cooling-off period: Implement a 24-hour rule for non-essential gaming purchases

Monitor Your Credit Score

- Regular checks: Review your credit report at least annually

- Free resources: Use credit card issuer FICO score access or free services like Credit Karma

- Credit factors: Understand how utilization, payment history, and applications affect your score

- Future opportunities: Better credit opens doors to more rewarding cards

Strategic Application Timing

- Research thoroughly: Compare card options before applying

- Spacing applications: Wait 3-6 months between credit card applications

- Promotional alignment: Time applications with major spending or the best signup bonuses

- Long-term value: Choose cards that will remain valuable beyond initial promotions

To protect yourself from potential issues while pursuing GameStop gift cards, be sure to read our guide on How to Spot and Avoid GameStop Gift Card Scams.

Conclusion

Using credit cards to earn GameStop gift cards can be a savvy way to fund your gaming hobby without additional out-of-pocket expenses. By strategically selecting the right card based on your spending patterns and redemption preferences, you can generate substantial rewards toward your gaming purchases.

The most effective approach is often a hybrid strategy—combining a strong rewards credit card with GameStop’s own loyalty program and possibly other earning methods. Remember that the best credit card for GameStop rewards is ultimately the one that aligns with your specific spending habits and financial situation.

As you explore these options, prioritize responsible credit use above all else. No gaming reward is worth compromising your financial health through debt or overspending. Choose wisely, use your cards strategically, and enjoy the satisfaction of funding your gaming passion through smart financial management.

Before applying for any credit card, carefully review the current terms and conditions on the issuer’s website, as offers and features may change over time.

For more comprehensive strategies to save on gaming purchases, be sure to check out our pillar article on 10 Best Ways to Earn GameStop Gift Cards.

Disclaimer: This article contains general information and should not be construed as financial advice. Credit card decisions should be made with careful consideration of your personal financial situation. Card terms and benefits are subject to change; always verify current offers directly with the card issuer.