Best Macy’s Credit Cards for Rewards & Shopping

In today’s competitive retail landscape, savvy shoppers are constantly looking for ways to stretch their dollars further. One of the most effective strategies is utilizing Macy’s credit cards and rewards programs to enhance your shopping experience while earning valuable benefits. With the right credit card rewards strategy, you can transform everyday purchases into significant savings at one of America’s most iconic department stores.

Macy’s credit cards offer dedicated shoppers a way to earn points, access exclusive discounts, and enjoy special perks that aren’t available to the general public. However, navigating the various options can be overwhelming—from Macy’s own branded cards to general shopping rewards cards that offer flexibility for Macy’s purchases.

This comprehensive guide explores the best credit card for Macy’s shopping, comparing both store-specific and general rewards cards to help you determine which option best aligns with your spending habits and financial goals. Whether you’re a frequent Macy’s shopper or an occasional visitor looking to maximize value, understanding the nuances of each card’s rewards structure can lead to substantial savings over time.

Macy’s American Express Card: The Dedicated Option

For loyal Macy’s customers, the Macy’s credit card portfolio includes the premium Macy’s American Express Card. This card offers enhanced benefits beyond the standard Macy’s store card while maintaining the same core advantages for dedicated shoppers.

Detailed Benefits & Rewards Program

The Macy’s American Express Card incorporates the Star Rewards program, which is tiered based on your annual spending at Macy’s:

- Bronze Level (Up to $499 annual spend)

- 1% back in Star Money rewards on Macy’s purchases

- Star Money Bonus Days

- Birthday surprise

- Silver Level ($500-$1,199 annual spend)

- 2% back in Star Money rewards on Macy’s purchases

- Free shipping on Macy’s purchases with no minimum

- All Bronze benefits

- Gold Level ($1,200+ annual spend)

- 3% back in Star Money rewards on Macy’s purchases

- Free shipping on Macy’s purchases with no minimum

- All Bronze benefits

- Personalized Macy’s offers

The American Express version adds these additional benefits:

- 3% back in Star Money at restaurants (including takeout and delivery)

- 2% back in Star Money at supermarkets and gas stations

- 1% back in Star Money on all other eligible purchases

- No annual fee

- Access to American Express experiences and offers

Real Value Example: A Gold tier member spending $2,000 annually at Macy’s would earn $60 worth of Star Money, plus additional rewards on non-Macy’s purchases when using the American Express card.

For a deeper analysis of whether these rewards are worthwhile, check out our detailed article: Macy’s Star Rewards: Is it Worth it? A Detailed Review.

Interest Rates and Fees

Before applying for any Macy’s credit card, it’s crucial to understand the associated costs:

| Fee Type | Macy’s American Express Card |

|---|---|

| Annual Fee | $0 |

| APR for Purchases | 28.49% Variable |

| Balance Transfer Fee | $5 or 4% (whichever is greater) |

| Foreign Transaction Fee | 3% |

| Late Payment Fee | Up to $41 |

The high APR is particularly noteworthy—at 28.49% variable, this rate is substantially higher than many general-purpose credit cards. This makes carrying a balance extremely expensive and can quickly negate any rewards earned.

Pros and Cons

| Pros | Cons |

|---|---|

| Enhanced Star Rewards earning rate for Macy’s purchases | Very high APR compared to general rewards cards |

| No annual fee | Limited redemption options (primarily for Macy’s purchases) |

| Special financing offers and exclusive shopping events | Requires good to excellent credit for approval |

| Early access to sales and special promotions | Foreign transaction fees make it less ideal for international travel |

| Additional American Express benefits and protections | Lower overall rewards rate compared to some general-purpose cards |

| Rewards on everyday spending categories beyond Macy’s |

General Rewards Credit Cards for Macy’s Shopping

While the Macy’s credit card options provide direct benefits for in-store purchases, several general-purpose shopping rewards cards offer compelling alternatives—particularly for those who shop at multiple retailers beyond Macy’s.

Chase Freedom Unlimited

The Chase Freedom Unlimited has become a favorite among rewards enthusiasts for its straightforward earning structure and flexible redemption options, making it a strong contender for the best credit card for Macy’s shopping despite not being store-branded.

Key Features:

- 1.5% unlimited cash back on all purchases

- Additional bonus categories:

- 5% back on travel purchased through Chase

- 3% back at restaurants

- 3% back at drugstores

- No annual fee

- 0% intro APR offer for purchases and balance transfers (typically 15 months)

- Sign-up bonus for new cardholders

How to Redeem for Macy’s Gift Cards: Chase Ultimate Rewards points can be redeemed for gift cards at a 1:1 value (1 cent per point), allowing you to convert your rewards directly into Macy’s gift cards through the Chase rewards portal. A $50 Macy’s gift card would cost 5,000 Ultimate Rewards points.

For additional ways to leverage rewards programs together, see our comparison: Rakuten vs. Ibotta: Which Cashback Program is Best for Macy’s Shoppers?

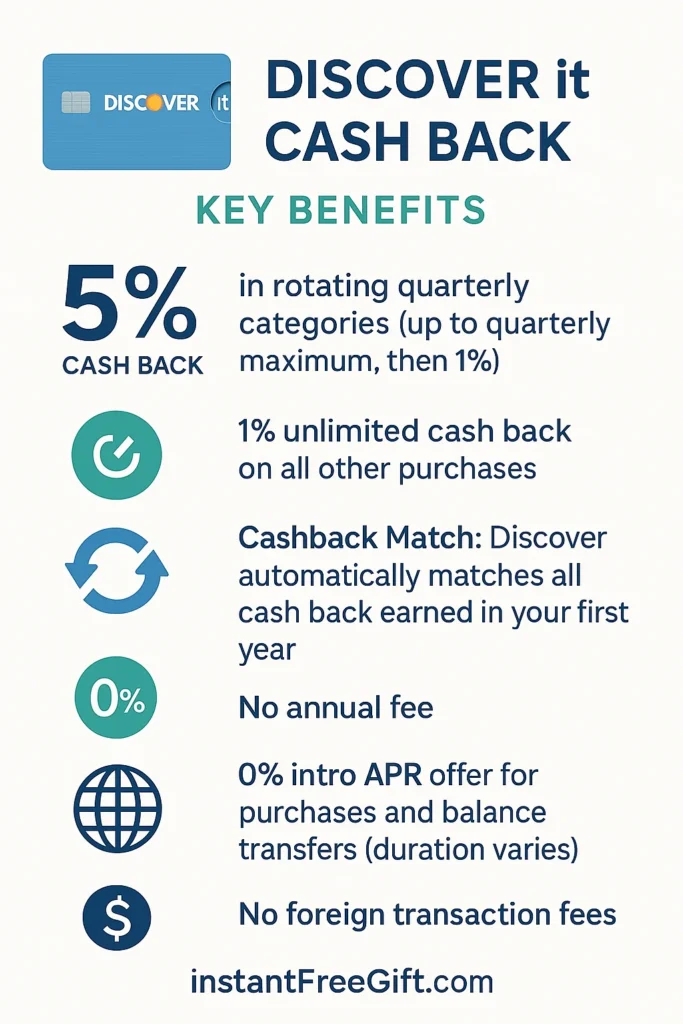

Discover it Cash Back

The Discover it Cash Back card offers a unique rewards structure that can be particularly valuable for Macy’s shoppers who plan their larger purchases strategically.

Key Features:

- 5% cash back in rotating quarterly categories (up to quarterly maximum, then 1%)

- 1% unlimited cash back on all other purchases

- Cashback Match: Discover automatically matches all cash back earned in your first year

- No annual fee

- 0% intro APR offer for purchases and balance transfers (duration varies)

- No foreign transaction fees

How to Redeem for Macy’s Gift Cards: Discover allows direct redemption of cash back rewards for Macy’s gift cards, sometimes with added value (e.g., a $20 gift card for $18 in rewards). Additionally, Macy’s occasionally appears as a 5% category, substantially boosting your rewards during those quarters.

Citi Double Cash Card

For simplicity and consistent value, the Citi Double Cash Card offers an attractive proposition for those seeking a credit card rewards program without category restrictions.

Key Features:

- 2% total cash back: 1% when you make purchases and 1% when you pay them off

- No annual fee

- Access to Citi Entertainment for presale tickets and exclusive experiences

- Basic travel and purchase protections

How to Redeem for Macy’s Gift Cards: Citi ThankYou points can be redeemed for Macy’s gift cards through the ThankYou Rewards portal. The standard redemption rate offers $25 Macy’s gift cards for 2,500 ThankYou points, maintaining the 1 cent per point value.

American Express Blue Cash Preferred

For households with significant grocery spending, the Blue Cash Preferred card can generate substantial rewards that can then be redirected toward Macy’s purchases.

Key Features:

- 6% cash back at U.S. supermarkets (up to $6,000 per year, then 1%)

- 6% cash back on select U.S. streaming subscriptions

- 3% cash back on transit and U.S. gas stations

- 1% cash back on all other purchases

- $95 annual fee

- Welcome bonus for new cardholders

How to Redeem for Macy’s Gift Cards: American Express Membership Rewards can be redeemed for Macy’s gift cards through the Amex rewards portal, typically at a value of 0.7-1 cent per point depending on current promotions.

If you’re interested in alternative ways to earn Macy’s gift cards without credit cards, explore our guide: The Ultimate Guide to Earning Gift Cards with Swagbucks.

Pros and Cons of General Rewards Cards

Pros:

- Lower APRs compared to store cards (typically 16-24% variable)

- More flexible rewards redemption options

- Stronger welcome bonuses and introductory offers

- Better overall earning rates on everyday spending

- More robust card benefits and protections

- Can be used anywhere, not just at Macy’s

Cons:

- No direct integration with Macy’s Star Rewards program

- No access to Macy’s-specific perks like dedicated sales events

- May require more effort to redeem rewards for Macy’s shopping

- Some cards charge annual fees

- Best cards typically require good to excellent credit

For more information on how to maximize general credit card rewards for store-specific shopping, check out our comprehensive guide: How to Earn Macy’s Gift Cards.

Comprehensive Comparison: Finding Your Ideal Card

When evaluating the best credit card for Macy’s shopping, consider how each option aligns with your spending patterns and preferences. This comparison table highlights key differences to help inform your decision:

| Feature | Macy’s American Express | Chase Freedom Unlimited | Discover it Cash Back | Citi Double Cash | Amex Blue Cash Preferred |

|---|---|---|---|---|---|

| Annual Fee | $0 | $0 | $0 | $0 | $95 |

| Regular APR | 28.49% Variable | 18.74%-27.49% Variable | 16.24%-27.24% Variable | 18.24%-28.24% Variable | 18.24%-29.24% Variable |

| Sign-up Bonus | Occasional 20% off first purchase | $200 after spending $500 in first 3 months | Cashback match for first year | None | $250 after spending $3,000 in first 6 months |

| Macy’s-Specific Benefits | Star Rewards program integration, exclusive events | None | None | None | None |

| Everyday Reward Rate | 1-3% at Macy’s; 1-3% in select categories | 1.5% on all purchases; 3-5% in bonus categories | 1% on all purchases; 5% in rotating categories | 2% on all purchases (1% when buying, 1% when paying) | 1% on standard purchases; 3-6% in bonus categories |

| Redemption Flexibility | Limited to Macy’s rewards | Highly flexible | Highly flexible | Highly flexible | Highly flexible |

| Foreign Transaction Fee | 3% | 3% | None | 3% | 2.7% |

This side-by-side comparison reveals important distinctions that can help determine which card offers the most value based on your specific situation and shopping habits.

How to Choose the Right Credit Card for Macy’s Rewards

Selecting the best credit card for Macy’s purchases depends on several key factors that vary from person to person. Consider these elements when making your decision:

1. Shopping Frequency at Macy’s

Frequent Macy’s Shoppers: If you shop at Macy’s multiple times per month or spend more than $1,200 annually, the dedicated Macy’s credit card options provide targeted benefits that can outweigh general rewards cards, particularly if you reach Gold or Platinum status.

Occasional Macy’s Shoppers: If you visit Macy’s just a few times a year, a general-purpose rewards card likely offers better overall value and flexibility.

2. Payment Habits

Always Pay in Full: If you consistently pay your balance in full each month, prioritize rewards rates and benefits over APR considerations.

Sometimes Carry a Balance: If you occasionally carry a balance, the high APR of store cards can be prohibitively expensive. In this case, a general rewards card with a lower interest rate would be preferable.

Warning: Carrying a balance at 28.49% APR on a Macy’s card would cost $28.49 in interest annually for every $100 balance—quickly erasing the value of any rewards earned.

3. Redemption Preferences

Macy’s-Focused: If you want simplicity and automatic rewards specifically for Macy’s shopping, their branded cards offer the most direct path.

Flexibility Desired: If you prefer the option to use rewards for cash back, travel, or gift cards at various retailers, a general rewards card provides significantly more flexibility.

For detailed steps on converting rewards to Macy’s gift cards through specific programs, see our guide: Fetch Rewards for Macy’s Gift Cards: A Step-by-Step Guide.

4. Additional Card Benefits

Consider which supplementary benefits matter most to you:

- Purchase protection (generally stronger on general rewards cards)

- Extended warranties (typically better on general rewards cards)

- Special financing offers (often available on store cards)

- Exclusive shopping events (a feature of store cards)

5. Credit Profile Considerations

Excellent Credit: With excellent credit, you’ll likely qualify for the best general rewards cards with competitive sign-up bonuses and benefits.

Fair or Building Credit: Store cards like the basic Macy’s credit card can sometimes be easier to qualify for than premium general rewards cards, potentially making them a better option for those with limited or fair credit histories.

If you’re considering alternative ways to save at Macy’s beyond credit cards, our article Are Online Survey Sites a Scam? What to Know Before You Get Started examines legitimate options for earning rewards.

Maximizing Value: Strategic Approaches

Beyond simply choosing the right card, implementing these strategies can help you extract maximum value from your credit card rewards when shopping at Macy’s:

Stack Rewards Programs

Combine multiple rewards systems for greater impact:

- Use your chosen credit card for Macy’s purchases

- Enroll in Macy’s Star Rewards program (even without their credit card)

- Click through shopping portals like Rakuten or TopCashback

- Utilize store coupons and promotional codes

This “quadruple dipping” approach can sometimes yield total returns exceeding 10% on a single purchase.

Time Your Major Purchases

Align significant Macy’s shopping with these opportunities:

- Quarterly bonus categories on cards like Discover it (when department stores or PayPal are featured)

- Macy’s Friends & Family sales (typically offering 25% off)

- Credit card sign-up bonus periods (when you need to meet minimum spend requirements)

- Promotional rewards offers (when issuers offer bonus points at department stores)

Leverage Price Protection and Return Policies

Many general rewards cards offer price protection services that Macy’s store cards don’t provide. If you purchase an item that later goes on sale, these features can help you recover the difference without affecting your rewards.

Expert Tip: Set calendar reminders to check for price drops within your card’s price protection window (typically 60-90 days) after making major Macy’s purchases.

Conclusion: Making the Smart Card Choice for Macy’s Shopping

After examining the various options for Macy’s credit cards and general rewards cards, several key insights emerge:

For dedicated Macy’s shoppers who consistently reach Gold or Platinum status and always pay their balance in full, the Macy’s American Express Card offers compelling value through the combination of tiered rewards, special events, and additional earning categories.

However, for most consumers, a general rewards card like the Chase Freedom Unlimited or Discover it Cash Back provides better overall value, lower interest rates, and significantly greater flexibility—while still offering competitive returns on Macy’s purchases through gift card redemptions.

The ideal approach often involves a strategic combination: using a high-earning general rewards card for most purchases, while selectively taking advantage of special financing offers or promotions from store cards for major purchases when the math makes sense.

Remember that the best credit card for Macy’s shopping is ultimately the one that aligns with your personal spending patterns, financial habits, and rewards preferences. By thoughtfully evaluating these factors, you can select a card that maximizes your shopping savings while supporting healthy financial practices.

Recommended Cards

Based on our analysis, these cards represent the strongest options for different types of shoppers:

- Best for Frequent Macy’s Shoppers: Macy’s American Express Card

- Best for General Shopping with Good Macy’s Rewards: Chase Freedom Unlimited

- Best for Strategic Category Shoppers: Discover it Cash Back

- Best for Simplicity and Consistent Value: Citi Double Cash

- Best for Households with High Grocery Spending: American Express Blue Cash Preferred

Whichever card you choose, remember that responsible credit use—paying balances in full and on time—is the foundation of any successful rewards strategy.

Disclaimer: Credit card offers are subject to change. Information presented is accurate as of April 2025. This article contains affiliate links; if you apply and are approved for a card through these links, we may receive compensation from the card issuers. Please consult the official credit card websites (American Express, Chase, Discover, Citi, Macy’s) and review the terms and conditions before applying.

What’s your experience with using credit cards at Macy’s? Share your thoughts in the comments below!